![]() 14ymedio, Elías Amor Bravo, Economist, 14 March 2023 — The analysis of the tourism sector in 2022 can be gleaned from the data of the publication “Tourism. Selected Indicators” of the National Office of Statistics and Information (ONEI), which has just been released.

14ymedio, Elías Amor Bravo, Economist, 14 March 2023 — The analysis of the tourism sector in 2022 can be gleaned from the data of the publication “Tourism. Selected Indicators” of the National Office of Statistics and Information (ONEI), which has just been released.

In it, data are presented for income, overnight stays and occupancy rates, among other indicators of the businesses served by MINTUR [Ministry of Tourism], Gaviota and Palco, which involve accommodation, retail trade, gastronomy, transport, recreation and other income generators.

When an analysis is carried out with respect to the previous year, significant growth in tourism activity is contemplated, but since 2021 was a very bad year for tourism due to the outbreaks of COVID-19 that continued to affect international tourism.

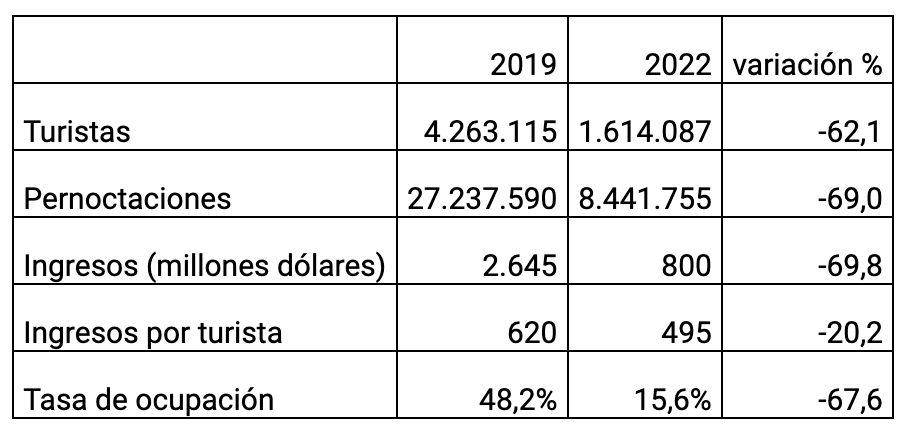

Therefore, and with the aim of carrying out an adequate analysis of the trends in the sector in 2022, it is advisable to use 2019 as a reference, since it was the last “normal” year before the pandemic. International tourism data are shown in the following table.

The number of international tourists stood at 62.1% less than the 2019 data, but the indicator of overnight stays that combines the number of tourists and days decreased even more, by 69%.

This is a lower percentage than that experienced by the occupancy rate, which fell from 48.2% in 2019 to 15.6% in 2022, a collapse of 67.6%. It offers an idea of the direct impact that this will have on the profitability levels of hotel management.

Tourism income (applied to the official exchange rate of the regime) did not exceed 800 million dollars, 69.8% less than in 2019, and income per tourist stood at 495 dollars, 20.2% less than in that year. These numbers could be even lower if the alternative exchange rate (between the dollar and the peso) of 1×120 or the one that governs the informal market is applied.

If the comparison of data was made with respect to 2021, as they do in the ONEI report, the panorama changes, because 2021 was a very negative year, in which only 356,470 tourists arrived in Cuba, and revenues did not exceed 365 million dollars.

While tourism in Cuba fell behind, other competing countries in the Caribbean recovered to the levels they experienced before 2020. In such conditions, the 2022 recovery in Cuba is insufficient, and there are reasons to think that the distances that have to be traveled to return to a normal scenario are still very important. What is worse, it does not seem that in this year, 2023, the gap will be closed.

To cite an example that shows the difficulties the sector has in recovering, it is important to take into account that Canada, the main tourist market for the Island, barely contributed 532,487 tourists in 2022, a figure that is nowhere near the one for 2019, when 1,120,077 Canadians arrived on the Island. Canadian tourism is 52.2% below the 2019 figure.

Certainly, those responsible for tourism in Cuba must be very concerned with figures like these. That only 9% of Canadians who came in 2019 did so in 2022 is, to say the least, alarming. There is a lot to do. But it’s the same in other geographical markets that offer similar signs of collapse, with problems that will have to be overcome.

For example, the second market in origin, the Cuban community abroad, fell from 623,972 tourists in 2019 to 333,191 in 2022. The Russians, with their transportation difficulties, from 177,977 in 2019 to 54,383 in 2022. And so, on. The declines are significant, and no market shows symptoms of recovery. In 2023, the levels before 2020 will not be reached, and this will have very negative repercussions on the entire economic activity of the Island.

Translated by Regina Anavy

____________

COLLABORATE WITH OUR WORK: The 14ymedio team is committed to practicing serious journalism that reflects Cuba’s reality in all its depth. Thank you for joining us on this long journey. We invite you to continue supporting us by becoming a member of 14ymedio now. Together we can continue transforming journalism in Cuba.