14ymedio, Mario Penton, Miami, 12 October 2017 — Russia is again aiding Cuba and, as with the Soviet Union in the 1970s and 1980s, the aid comes in the form of oil. Moscow is trying to compensate for the collapse of Venezuelan shipments, but part of the bill comes from Caracas, says Jorge Piñón, director of the International Energy Center at the University of Texas.

According to the Russian news agency Tass, last weekend the Kremlin agreed with the Palace of the Revolution to increase the supply of oil and develop cooperation in the extraction sector in Cuba.

“This is a triangulation of an agreement signed in 2016 and extended this year. Rosneft (a joint-venture company majority-owned by the Russian government) has loaned PDVSA (the Venezuelan state oil company) between four and five billion dollars in recent years, “says Piñón. “Part of the 250,000 tonnes of diesel that Rosneft pledged in May to deliver to Cuba was funded in the back office through the triangulation of the agreement with PDVSA.”

Piñón’s thesis is also supported by statements from Russian Energy Minister Alexander Novak, who last May put as a condition on shipments of oil to the island that they must have a secure source of funding.

During the Soviet era, Cuba received more than $40 billion in subsidies and contracted a $35 billion debt that Russia condoned by 90 percent in 2014. At that time the USSR was sending oil to the Island, which the Cuban authorities partially re-exported to the international price. It did the same with a part of the shipments of Venezuela, that reached 100,000 barrels a day before falling to a little more than half that.

In addition to supplying oil and diesel, Rosneft intends to fulfill an unfinished promise of the late Venezuelan president Hugo Chávez: the modernization of the Cienfuegos refinery, the largest in the country, operating at half speed because of the fall of the Venezuelan oil deliveries.

According to several analysts, Caracas sends 55,000 barrels of oil daily to Havana, far from the 87,000 it supplied last year and the 100,000 barrels supplied during the life of Hugo Chavez. In return, Havana sells to Caracas, at very inflated prices, its doctors serving on medical missions and other professionals providing other types of service.

Under the government of Nicolás Maduro the payment through this model has abruptly dropped. Cuba has not published its earnings from the export of services since 2014 but, as economists Carmelo Mesa-Lago and Omar Everleny Pérez have reported, these earnings have fallen by more than 1.3 billion dollars in recent years.

Economy Minister Ricardo Cabrisas said in July that the country was forced to import 99.6 million dollars in fuels so far this year due to non-compliances in the delivery of petroleum products from Caracas. Last year, Cuba was forced to import fuel from Algeria, and Raul Castro himself sent a letter to Vladimir Putin asking for a stable supply from Russia.

Jorge Piñón believes that it will be difficult for Cuba to find another Venezuela like that of Hugo Chavez willing to pay its oil bill: “The value of the Cuban oil deficit is approximately 1.1 billion dollars a year if we value a barrel at 45 dollars. Who and how is that bill to be paid?” he asks, since Havana does not have the financial resources.

Neither does he believe that Russia will assume the cost of refurbishing the Cienfuegos refinery, which the expert says needs between three and five billion dollars of investment.

“For example, we have the great Refinery of the Pacific, in Ecuador, that for the last ten years has been looking for partners after the Venezuelans ‘embarked’,” he cites as an example.

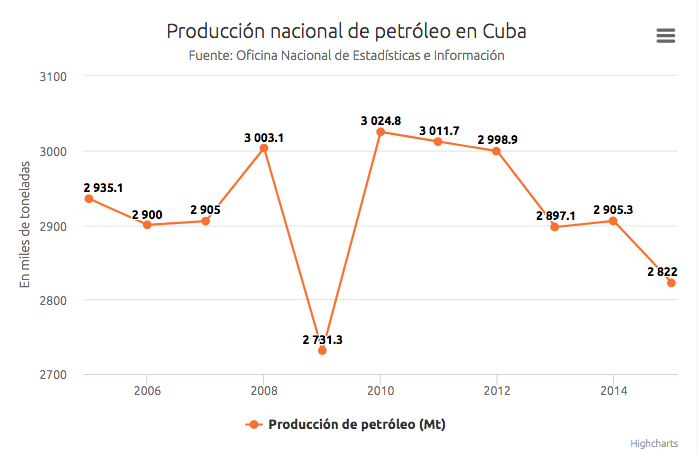

Data provided by the National Bureau of Statistics and Information show that oil production on the island has steadily declined over the last decade. In 2015 (latest figures published), Cuba produced 2,822,000 tonnes of crude oil, some 202,800 tonnes less than in 2010.

National oil production in Cuba. Source: National Bureau of Statistics and Information

National production barely covers 48% of energy demand, as reported by the authorities of the Cuba Petroleum Union in an interview with the national press. The cost of extracting a barrel of oil on the Island is around $14, but it is of low quality and therefore needs to be mixed with other fuels to be used.

The deposits in operation are located in the north-western fringe of the island. After more than 40 years of operation the yield of the wells has fallen, which is reflected in the volume of extracted oil.

On the other hand, some of the most important deposits are located in Varadero, the main tourist center of the country, which makes it difficult to extract, according to authorities, who estimate to 11 billion barrels of oil reserves in that area of the country.

Cuba’s biggest bet is its exclusive economic zone in the Gulf of Mexico (about 112,000 square kilometers), open to foreign investment since 1999, with high costs and investment risks in the Gulf’s deep waters. Russians, Canadians and Venezuelans have invested there without much results. This week, however, the Australian company Melbana Energy will begin exploration of the oil wells it has identified in the northern coast of Cuba.